Millions of dollars in unclaimed funds are waiting to be claimed across Pennsylvania, and you might be entitled to a share of this forgotten wealth. Unclaimed funds can include forgotten bank accounts, uncashed checks, insurance payouts, utility deposits, and more. The Pennsylvania Treasury Department actively works to reunite these funds with their rightful owners, but many people remain unaware of their eligibility. By taking a few simple steps, you can discover if you have unclaimed money waiting for you and reclaim what is rightfully yours.

Every year, thousands of Pennsylvanians miss out on unclaimed funds simply because they don’t know where to look or how to claim them. The state government has set up an easy-to-use database to help individuals and businesses track down lost assets. This guide will walk you through the process, offering tips and insights to maximize your chances of finding unclaimed funds. Whether you're looking for personal or business-related assets, this resource is designed to simplify your search.

Understanding the concept of unclaimed funds is crucial for anyone seeking to reclaim lost money. These funds often go unclaimed due to changes in address, forgotten accounts, or lack of awareness. By utilizing the tools provided by the Pennsylvania Treasury and following the steps outlined in this article, you can ensure that your financial future remains secure. Let’s dive deeper into the world of unclaimed funds and uncover the secrets to unlocking your hidden wealth.

Read also:Unveiling The Power Of Emagine Saline Solutions Your Ultimate Guide

What Are Pennsylvania Unclaimed Funds?

Unclaimed funds in Pennsylvania refer to financial assets that have been separated from their rightful owners for various reasons. These assets may include bank accounts, dividends, refunds, and other monetary holdings. The Pennsylvania Treasury Department holds these funds until they are claimed by the rightful owner. It’s essential to understand the types of assets that fall under this category to maximize your search efforts.

Why Should You Care About Pennsylvania Unclaimed Funds?

Unclaimed funds can significantly impact your financial well-being. Whether it's a small refund or a substantial inheritance, these funds belong to you and can provide much-needed financial relief. By actively searching for unclaimed funds, you can recover assets that might otherwise remain untouched indefinitely. This section will explore the benefits of reclaiming unclaimed funds and highlight real-life success stories.

How Do Pennsylvania Unclaimed Funds Work?

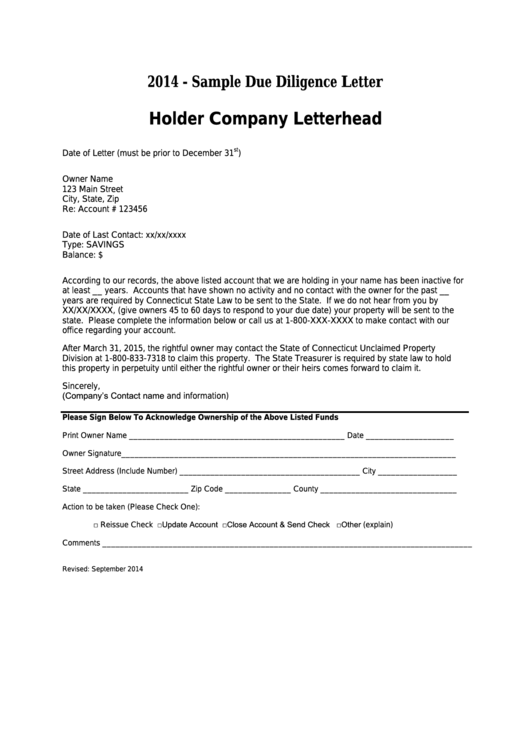

The process of identifying and reclaiming unclaimed funds involves several steps. First, businesses and organizations are required by law to report dormant accounts to the Pennsylvania Treasury after a certain period of inactivity. Once reported, the funds are held in trust until claimed by the rightful owner. This section will break down the mechanics of the unclaimed funds system and explain how the state ensures the security of these assets.

How Can You Search for Pennsylvania Unclaimed Funds?

Searching for unclaimed funds is easier than you might think. The Pennsylvania Treasury provides an online database that allows users to search for potential matches using their name or business name. Below are some tips to enhance your search:

- Use variations of your name, including maiden names or nicknames.

- Include all addresses where you’ve lived in Pennsylvania.

- Check for both individual and business-related assets.

What Happens If You Find Pennsylvania Unclaimed Funds?

If your search yields results, the next step is to file a claim. The Pennsylvania Treasury requires specific documentation to verify your identity and ownership of the funds. This typically includes proof of identification, address verification, and any relevant account information. This section will guide you through the claims process and offer advice on avoiding common pitfalls.

Can You Claim Pennsylvania Unclaimed Funds for a Deceased Relative?

Yes, you can claim unclaimed funds on behalf of a deceased relative, provided you have the legal authority to do so. This often involves producing a copy of the death certificate and documentation proving your relationship to the deceased. Understanding the inheritance laws in Pennsylvania is critical when pursuing claims for a deceased person. This section will delve into the legal aspects of claiming unclaimed funds for a deceased relative.

Read also:Unveiling The Power Of The Byford Dolphin Diver 4 A Deep Dive Into Its Capabilities

Are Pennsylvania Unclaimed Funds Taxable?

The tax implications of unclaimed funds depend on the type of asset and how long it has been held. In most cases, the original owner is responsible for any taxes owed on the funds. However, once the funds are claimed, they are treated like any other income or asset for tax purposes. This section will clarify the tax considerations associated with unclaimed funds and provide guidance on navigating the tax implications.

How Long Do Pennsylvania Unclaimed Funds Stay Active?

Unclaimed funds in Pennsylvania remain active indefinitely, meaning there is no expiration date for claiming them. However, the sooner you initiate the claims process, the better your chances of recovering the funds without complications. This section will address the timeline for claiming unclaimed funds and explain why prompt action is beneficial.

What Should You Do If Pennsylvania Unclaimed Funds Are Not Found?

Not finding unclaimed funds during your initial search doesn’t mean they don’t exist. Sometimes, assets may be listed under different names or addresses. Expanding your search parameters and using additional resources can increase your chances of success. This section will outline alternative methods for locating unclaimed funds and suggest professional services that specialize in this area.

Table of Contents

- What Are Pennsylvania Unclaimed Funds?

- Why Should You Care About Pennsylvania Unclaimed Funds?

- How Do Pennsylvania Unclaimed Funds Work?

- How Can You Search for Pennsylvania Unclaimed Funds?

- What Happens If You Find Pennsylvania Unclaimed Funds?

- Can You Claim Pennsylvania Unclaimed Funds for a Deceased Relative?

- Are Pennsylvania Unclaimed Funds Taxable?

- How Long Do Pennsylvania Unclaimed Funds Stay Active?

- What Should You Do If Pennsylvania Unclaimed Funds Are Not Found?

- Final Thoughts on Pennsylvania Unclaimed Funds

Final Thoughts on Pennsylvania Unclaimed Funds

Reclaiming unclaimed funds in Pennsylvania is a straightforward process that can yield significant financial rewards. By leveraging the resources provided by the Pennsylvania Treasury and following the steps outlined in this guide, you can unlock hidden wealth and secure your financial future. Remember, these funds belong to you, and it’s your right to reclaim them. Stay vigilant, stay informed, and take the first step toward discovering your unclaimed assets today.

Whether you’re searching for forgotten bank accounts, unclaimed insurance payouts, or other lost assets, the Pennsylvania Treasury is committed to helping you recover what’s yours. Use the tools and insights provided in this article to embark on your journey toward financial discovery. With a little effort and persistence, you could uncover a treasure trove of unclaimed funds waiting to be claimed.