ABA routing numbers play a pivotal role in the banking system, ensuring seamless transactions and secure fund transfers. Often referred to as ABA RTN (American Bankers Association Routing Transit Number), these unique nine-digit codes identify financial institutions in the United States. Whether you're setting up direct deposits, initiating wire transfers, or paying bills online, understanding what an ABA routing number is and how it works can save you time and effort. This article dives deep into the topic, answering common questions and offering practical insights to help you navigate the world of banking with confidence.

For anyone unfamiliar with the concept, an ABA routing number might seem like just another banking term. However, its importance cannot be overstated. This number is essential for domestic transactions and ensures that your money reaches the correct institution without errors. As we explore further, you'll learn how to locate your ABA routing number, differentiate it from other bank codes, and understand its role in modern banking processes.

This guide is tailored to provide clarity and value, whether you're a beginner or someone looking to deepen their knowledge of banking systems. By the end of this article, you'll have a comprehensive understanding of "is aba routing number," its significance, and how it impacts your financial activities. Let's dive in!

Read also:Transform Your Space The Ultimate Guide To Living Room Theaters In Portland Oregon

What is an ABA Routing Number?

An ABA routing number is a nine-digit code assigned to financial institutions in the United States. It acts as a digital address, guiding banks and credit unions on where to send or receive money during transactions. This number was introduced in 1910 by the American Bankers Association to streamline the check-clearing process. Today, it serves a broader purpose, supporting electronic transfers, direct deposits, and bill payments.

Each ABA routing number is unique to a specific bank or branch location. The first two digits indicate the Federal Reserve Bank responsible for processing transactions, while the last digit serves as a checksum to verify the number's validity. This structure ensures accuracy and minimizes errors in financial operations.

How Do You Locate Your ABA Routing Number?

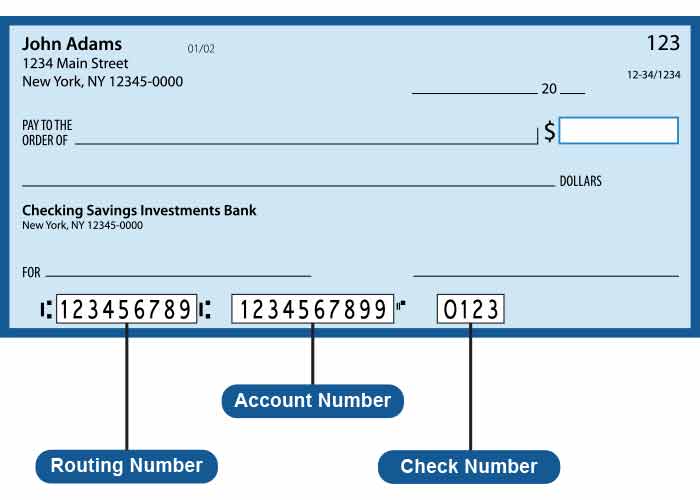

Finding your ABA routing number is straightforward. Here are some common methods:

- Check the bottom-left corner of your personal checks.

- Log in to your online banking account and look for the routing number in your account details.

- Contact your bank's customer service for assistance.

Remember, the ABA routing number may vary depending on the type of transaction and the bank's location. Always double-check to ensure you're using the correct number.

Why is ABA Routing Number Important?

The importance of an ABA routing number lies in its ability to facilitate accurate and secure transactions. Without it, banks would struggle to process payments efficiently. For example, when setting up a direct deposit for your salary, providing the correct ABA routing number ensures the funds land in your account without delays or errors.

Moreover, ABA routing numbers help prevent fraud by verifying the authenticity of financial institutions. This adds a layer of security to your banking activities, giving you peace of mind.

Read also:Discovering The Best S In Council Bluffs A Comprehensive Guide

Is ABA Routing Number the Same as SWIFT Code?

This is a common question among banking customers. While both codes serve a similar purpose, they differ significantly in scope and application. An ABA routing number is used exclusively for domestic transactions within the United States. In contrast, a SWIFT code facilitates international transactions by identifying banks globally.

It's crucial to distinguish between the two, especially when dealing with cross-border payments. Using the wrong code can lead to transaction failures or delays. Always confirm which code is required based on the nature of your transaction.

What Happens If You Use the Wrong ABA Routing Number?

Using an incorrect ABA routing number can cause significant issues, including:

- Transaction rejection or delay.

- Funds being sent to the wrong bank or branch.

- Potential fees for processing errors.

To avoid these problems, always verify the ABA routing number before initiating any transaction. If unsure, consult your bank's official website or contact their customer support team for clarification.

Can You Change Your ABA Routing Number?

Yes, but only under specific circumstances. Banks may update their ABA routing numbers due to mergers, acquisitions, or system upgrades. If your bank undergoes such changes, they will notify you in advance and provide guidance on updating your records.

For personal accounts, you cannot request a change to your ABA routing number unless your bank relocates or restructures its operations. In such cases, the new routing number will automatically apply to all your accounts.

Is ABA Routing Number Unique to Each Bank?

Absolute uniqueness is a defining feature of ABA routing numbers. Each bank or credit union in the United States is assigned its own set of routing numbers based on branch locations and transaction types. This ensures there's no overlap or confusion when processing payments.

However, some large banks may have multiple ABA routing numbers due to their extensive branch networks. In such cases, the correct number depends on your specific account and location.

How Does the "is aba routing number" Affect Online Banking?

In the era of digital banking, ABA routing numbers are more relevant than ever. They enable seamless electronic transfers, direct deposits, and bill payments without the need for physical checks. Understanding how "is aba routing number" works can enhance your online banking experience by reducing errors and speeding up transactions.

For instance, when setting up automatic payments for utilities or loans, providing the correct ABA routing number ensures timely deductions from your account. This convenience is a testament to the efficiency of modern banking systems.

Common Questions About ABA Routing Numbers

Here are answers to frequently asked questions about ABA routing numbers:

How Many Digits is an ABA Routing Number?

An ABA routing number always consists of nine digits. This standardized format ensures consistency and accuracy across all transactions.

Can You Use the Same ABA Routing Number for Multiple Accounts?

Yes, a single ABA routing number can be used for multiple accounts within the same bank. However, the account number accompanying it must differ to distinguish between accounts.

What Should You Do If Your ABA Routing Number Changes?

If your bank updates its ABA routing number, update all relevant records, including payroll systems, bill payment platforms, and direct deposit setups. Failing to do so can lead to transaction failures or delays.

Is ABA Routing Number Secure?

Yes, ABA routing numbers are secure and regulated by the American Bankers Association. They undergo rigorous verification processes to prevent misuse or fraud. Always treat your routing number with care and share it only with trusted entities.

Conclusion

In conclusion, understanding "is aba routing number" is essential for anyone engaged in banking activities. From facilitating seamless transactions to ensuring financial security, ABA routing numbers play a vital role in the modern banking landscape. By familiarizing yourself with their purpose, structure, and application, you can optimize your banking experience and avoid common pitfalls.

Remember to always verify your ABA routing number before initiating any transaction and update your records promptly in case of changes. With this knowledge, you're well-equipped to navigate the complexities of banking with confidence.

Table of Contents

- What is an ABA Routing Number?

- How Do You Locate Your ABA Routing Number?

- Why is ABA Routing Number Important?

- Is ABA Routing Number the Same as SWIFT Code?

- What Happens If You Use the Wrong ABA Routing Number?

- Can You Change Your ABA Routing Number?

- Is ABA Routing Number Unique to Each Bank?

- How Does the "is aba routing number" Affect Online Banking?

- Common Questions About ABA Routing Numbers

- Conclusion