Missouri's Department of Revenue plays a pivotal role in shaping the financial landscape of the state. Often referred to as the "mo department revenue," this organization manages critical financial systems such as taxation, licensing, and revenue collection. By ensuring compliance and generating funds for essential services, the department significantly impacts the lives of Missouri residents. Its responsibilities are vast, ranging from administering state taxes to overseeing motor vehicle registrations and business licenses. This article delves into the intricate workings of the Missouri Department of Revenue, highlighting its significance in sustaining economic stability and growth.

The department's operations are crucial for maintaining a balanced state budget, which in turn supports public services and infrastructure development. By effectively managing revenue streams, the Missouri Department of Revenue ensures that funds are allocated efficiently to various sectors, including education, healthcare, and transportation. In a rapidly evolving economic environment, the department continuously adapts its strategies to meet the needs of the state and its citizens. Its commitment to transparency and accountability is evident in its efforts to streamline processes and enhance taxpayer experience.

As we explore the workings of the "mo department revenue," it is essential to understand how this institution contributes to the state's overall fiscal health. Through innovative solutions and strategic planning, the department addresses challenges posed by economic fluctuations and changing societal needs. By leveraging technology and fostering collaboration with stakeholders, the Missouri Department of Revenue continues to uphold its mission of promoting economic prosperity and ensuring equitable access to resources for all residents.

Read also:Exploring The Fascinating World Of Benjamin Salisburys Influence

What Are the Primary Functions of the Missouri Department of Revenue?

The Missouri Department of Revenue is tasked with several critical responsibilities that underpin the state's financial framework. Its primary functions include administering state taxes, managing motor vehicle registrations, issuing driver's licenses, and overseeing business licenses. By efficiently collecting and distributing revenue, the department ensures that essential public services are adequately funded. Additionally, it plays a key role in enforcing tax laws and regulations, thereby maintaining fiscal integrity and promoting compliance among taxpayers.

How Does the MO Department Revenue Impact State Budget Allocation?

The impact of the Missouri Department of Revenue extends beyond revenue collection to influence state budget allocation. By accurately forecasting revenue streams and identifying potential areas for growth, the department aids in strategic financial planning. Its efforts ensure that funds are distributed equitably across various sectors, addressing the needs of diverse communities within the state. Furthermore, the department collaborates with other state agencies to optimize resource utilization and enhance the efficiency of public services.

Why Is Transparency Important for the MO Department Revenue?

Transparency is a cornerstone of the Missouri Department of Revenue's operations, fostering trust and accountability between the department and the public. By providing clear and accessible information about its processes and decisions, the department empowers citizens to understand how their taxes are utilized. This commitment to openness not only enhances taxpayer satisfaction but also encourages active participation in the state's financial governance. Through regular updates and communication, the department ensures that stakeholders remain informed and engaged.

What Challenges Does the MO Department Revenue Face in Today's Economy?

In today's dynamic economic landscape, the Missouri Department of Revenue encounters numerous challenges that require innovative solutions. Economic fluctuations, technological advancements, and evolving societal needs necessitate continuous adaptation and improvement in the department's operations. By embracing digital transformation and leveraging data analytics, the department aims to address these challenges effectively. Additionally, fostering partnerships with businesses and community organizations helps in identifying emerging trends and developing strategies to mitigate potential risks.

Exploring the Role of Taxation in MO Department Revenue

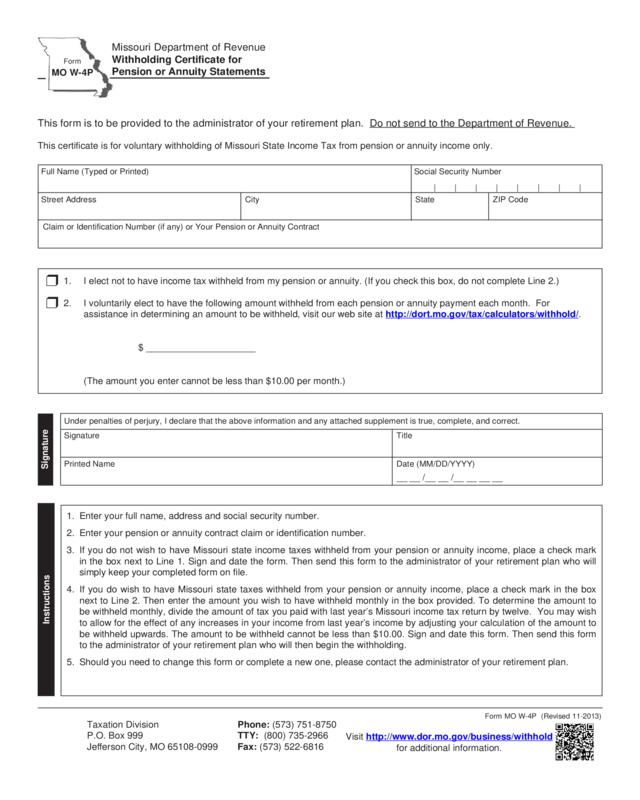

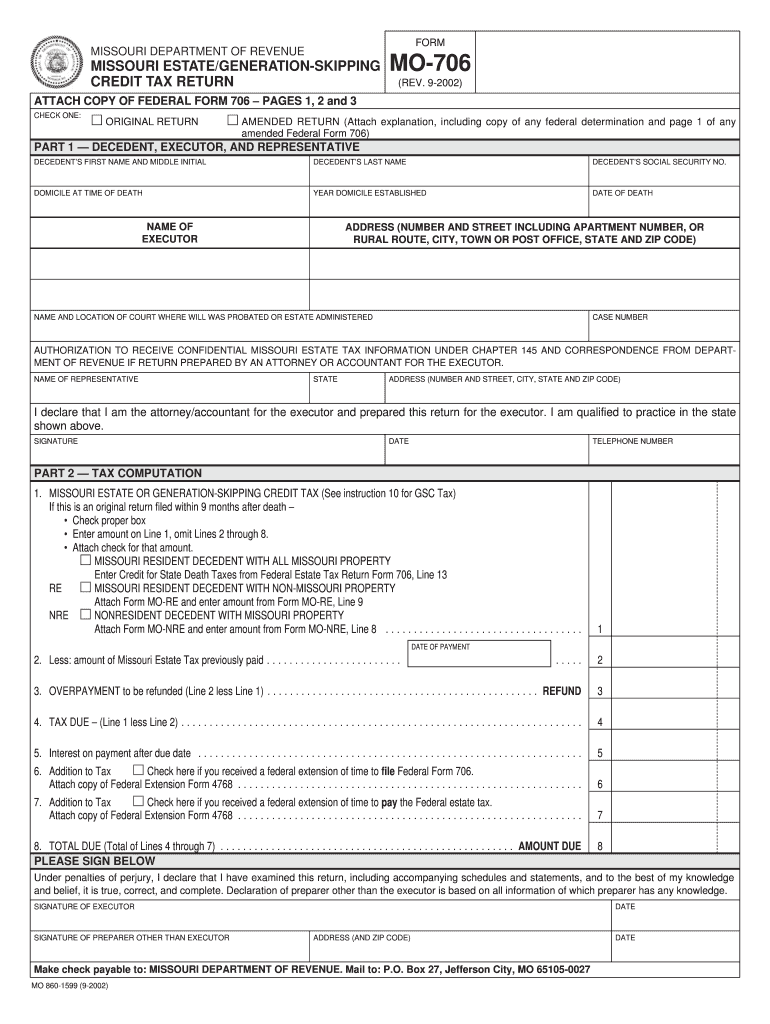

Taxation forms a significant part of the Missouri Department of Revenue's mandate, contributing substantially to the state's revenue generation. The department administers various types of taxes, including income tax, sales tax, and property tax, ensuring that funds are collected in compliance with state laws. By implementing robust systems for tax collection and enforcement, the department supports the financial health of Missouri. Furthermore, it offers assistance and resources to taxpayers, facilitating a seamless and transparent process for fulfilling their obligations.

Understanding the Licensing Functions of the MO Department Revenue

Beyond taxation, the Missouri Department of Revenue also oversees licensing functions, issuing permits and certifications to businesses and individuals. This aspect of its operations ensures that all entities operating within the state adhere to established standards and regulations. By maintaining a comprehensive database of licensed businesses and professionals, the department promotes a fair and competitive business environment. Additionally, it provides resources and support to help businesses navigate the licensing process, enhancing their ability to thrive and contribute to the state's economy.

Read also:Understanding The Cliff Mass Weather Forecast Your Ultimate Guide

MO Department Revenue and Its Contribution to Public Services

The Missouri Department of Revenue's efforts directly contribute to the enhancement of public services across the state. By efficiently managing revenue streams, the department ensures that funds are allocated to critical areas such as education, healthcare, and infrastructure development. Its commitment to supporting these sectors reflects its dedication to improving the quality of life for Missouri residents. Through strategic partnerships and collaborations, the department maximizes the impact of its contributions, fostering sustainable development and economic growth.

What Innovations Is the MO Department Revenue Implementing?

In response to the evolving needs of the state and its citizens, the Missouri Department of Revenue is implementing various innovations to enhance its operations. Leveraging technology, the department has introduced digital platforms for tax filing and payment, streamlining the process for taxpayers. Additionally, it employs advanced data analytics to improve forecasting accuracy and identify potential areas for revenue growth. By embracing these innovations, the department aims to deliver more efficient and effective services, meeting the demands of a modern economy.

MO Department Revenue's Commitment to Equity and Accessibility

Equity and accessibility are central to the Missouri Department of Revenue's mission, ensuring that all residents have fair access to its services and resources. The department actively seeks to eliminate barriers that may prevent individuals from fulfilling their financial obligations or accessing necessary licenses and permits. By offering multilingual support and accommodating diverse needs, it strives to create an inclusive environment that promotes equal opportunities for all. Through ongoing efforts to enhance accessibility, the department reinforces its commitment to serving the diverse communities within Missouri.

How Can Citizens Engage with the MO Department Revenue?

Citizens play a vital role in supporting the Missouri Department of Revenue's mission by actively engaging with its services and initiatives. Through regular communication and participation in public forums, individuals can provide valuable feedback and insights that inform the department's strategies and decisions. Additionally, utilizing available resources and tools, such as online portals and educational materials, enhances citizens' understanding of their responsibilities and rights. By fostering a collaborative relationship between the department and the public, Missouri can achieve greater financial stability and prosperity for all its residents.

Conclusion: The Future of Missouri's Department of Revenue

As Missouri continues to grow and evolve, the Department of Revenue remains a critical institution in shaping its financial future. By adapting to new challenges and embracing innovative solutions, the department ensures that it meets the needs of the state and its citizens. Its commitment to transparency, equity, and accessibility underscores its dedication to promoting economic stability and prosperity. Through continued collaboration and engagement with stakeholders, the Missouri Department of Revenue will undoubtedly play a pivotal role in driving the state's economic development in the years to come.

Table of Contents

- Unveiling the Role of Missouri's Revenue Department in Economic Stability

- What Are the Primary Functions of the Missouri Department of Revenue?

- How Does the MO Department Revenue Impact State Budget Allocation?

- Why Is Transparency Important for the MO Department Revenue?

- What Challenges Does the MO Department Revenue Face in Today's Economy?

- Exploring the Role of Taxation in MO Department Revenue

- Understanding the Licensing Functions of the MO Department Revenue

- MO Department Revenue and Its Contribution to Public Services

- What Innovations Is the MO Department Revenue Implementing?

- MO Department Revenue's Commitment to Equity and Accessibility