When it comes to banking and financial transactions, understanding the role of the Federal Reserve and its ABA routing numbers is essential for smooth operations. The Federal Reserve ABA number serves as a critical component in ensuring that funds are transferred accurately and securely between financial institutions. Whether you're a business owner or an individual managing your finances, having a clear grasp of how these numbers work can make a significant difference in your financial dealings. This article dives deep into the subject, offering valuable insights and practical tips to help you navigate this aspect of banking with confidence.

As financial systems continue to evolve, the importance of understanding routing numbers cannot be overstated. The Federal Reserve plays a pivotal role in the U.S. banking system, and its ABA numbers are instrumental in facilitating seamless transactions. By exploring the intricacies of the federal reserve aba number, we aim to equip you with the knowledge needed to optimize your banking processes. This guide will cover everything from the basics to advanced concepts, ensuring you have a comprehensive understanding of this crucial aspect of modern finance.

Our goal is to provide actionable insights that cater to both beginners and seasoned professionals. From defining what an ABA number is to examining its role in the Federal Reserve system, this article will address common questions and offer solutions to potential challenges. As you delve deeper into the content, you'll discover how the federal reserve aba number impacts everyday banking activities, making it an indispensable tool for anyone involved in financial transactions.

Read also:Understanding The Crucial Role Of The Secretary Of State In Modern Governance

What is the Federal Reserve ABA Number?

The Federal Reserve ABA number, often referred to as the routing transit number (RTN), is a nine-digit code assigned to financial institutions in the United States. It acts as a unique identifier that ensures accurate processing of checks, electronic funds transfers, and other financial transactions. This number is crucial for banks and credit unions to communicate with one another, ensuring that payments are directed to the correct institution and account.

How Does the Federal Reserve ABA Number Work?

The federal reserve aba number operates as a bridge between various financial institutions, enabling them to exchange funds efficiently. When you initiate a transaction, the ABA number is used to verify the identity of the involved parties and ensure that the funds are routed correctly. This system minimizes errors and enhances the security of financial operations, making it an integral part of the U.S. banking infrastructure.

Why is the Federal Reserve ABA Number Important?

Without a proper understanding of the federal reserve aba number, businesses and individuals may face delays or complications in their financial transactions. This number is vital for processes such as direct deposits, bill payments, and wire transfers. By knowing your institution's ABA number, you can streamline your banking activities and avoid potential issues that may arise from incorrect information.

Where Can You Find the Federal Reserve ABA Number?

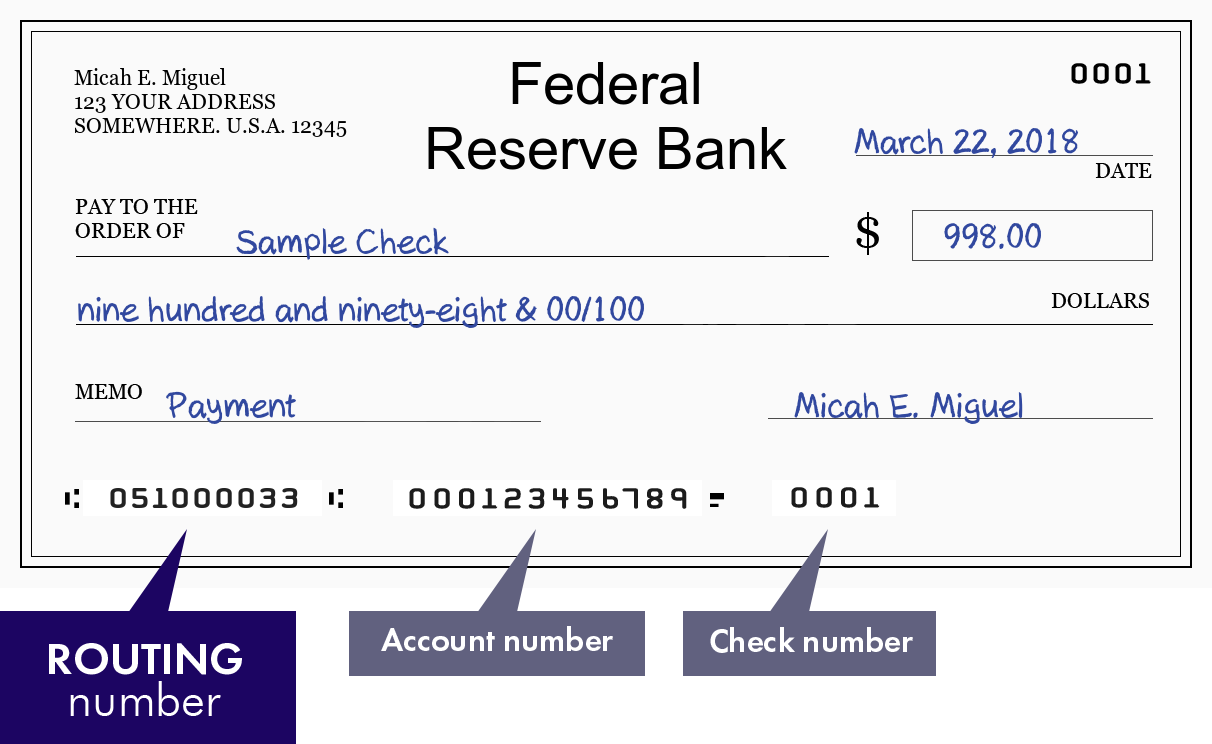

Locating your federal reserve aba number is relatively straightforward. It is typically printed at the bottom of your checks, alongside your account and check numbers. Alternatively, you can find it on your bank's official website or by contacting their customer service department. Ensuring you have the correct ABA number is crucial for initiating any financial transaction involving your bank.

How is the Federal Reserve ABA Number Assigned?

The assignment of the federal reserve aba number follows a systematic process designed to maintain consistency and accuracy across the banking industry. Each financial institution is assigned a unique code based on specific criteria, such as geographic location and the type of services offered. This ensures that every institution has a distinct identifier, preventing confusion and enhancing operational efficiency.

Can the Federal Reserve ABA Number Change?

Yes, the federal reserve aba number can change under certain circumstances, such as mergers, acquisitions, or changes in the institution's operational structure. It is essential to stay updated with any changes to your bank's ABA number to avoid disruptions in your financial transactions. Regularly checking your bank's communications and updates can help you stay informed and prepared.

Read also:Unveiling The Heartbeat Of Santa Clarita Your Ultimate Local News Guide

What Should You Do If Your Federal Reserve ABA Number Changes?

In the event of a change to your federal reserve aba number, it is crucial to update all relevant records, including payroll systems, bill payment platforms, and automatic transfers. Notify any entities that rely on your ABA number for transactions to ensure a seamless transition. Staying proactive can save you time and potential headaches in the long run.

What Are the Common Misconceptions About the Federal Reserve ABA Number?

Despite its importance, there are several misconceptions surrounding the federal reserve aba number. One common misunderstanding is that it is interchangeable with account numbers, which is not the case. Each serves a distinct purpose, and using them incorrectly can lead to transaction errors. Understanding the differences between these numbers is key to maintaining accurate financial records.

How Can You Avoid Errors When Using the Federal Reserve ABA Number?

To avoid errors, always double-check the federal reserve aba number before initiating any transaction. Ensure that you are using the correct number for your specific bank or credit union. Additionally, keep a record of your ABA number in a secure location for easy access when needed. By following these simple steps, you can minimize the risk of errors and ensure smooth financial operations.

Are There Different Types of Federal Reserve ABA Numbers?

Yes, there are different types of federal reserve aba numbers, each serving a specific purpose. For example, some numbers are designated for check processing, while others are used for electronic funds transfers. Understanding the distinctions between these numbers can help you choose the appropriate one for your transaction needs, ensuring efficiency and accuracy.

Table of Contents

- What is the Federal Reserve ABA Number?

- How Does the Federal Reserve ABA Number Work?

- Why is the Federal Reserve ABA Number Important?

- Where Can You Find the Federal Reserve ABA Number?

- How is the Federal Reserve ABA Number Assigned?

- Can the Federal Reserve ABA Number Change?

- What Should You Do If Your Federal Reserve ABA Number Changes?

- What Are the Common Misconceptions About the Federal Reserve ABA Number?

- How Can You Avoid Errors When Using the Federal Reserve ABA Number?

- Are There Different Types of Federal Reserve ABA Numbers?

In conclusion, the federal reserve aba number plays a vital role in the U.S. banking system, ensuring the accuracy and security of financial transactions. By understanding its function and importance, you can enhance your banking experience and avoid potential pitfalls. Whether you're managing personal finances or overseeing a business's financial operations, having a solid grasp of the federal reserve aba number is essential for success in today's financial landscape. Stay informed, stay proactive, and let this guide serve as your trusted resource for all things related to ABA numbers.

Remember, knowledge is power, and in the world of finance, the federal reserve aba number is a powerful tool. Use it wisely, and you'll be well-equipped to navigate the complexities of modern banking with confidence and ease.